Blog - ArchivesPosts of 12/2025

Nature reveals the most important scientific discoveries of 2025

From the discovery of a new layer of the immune system to ecosystems in the most extreme ocean depths

The prestigious scientific journal Nature has just published its annual list of the 10 people and discoveries that marked the year 2025, consolidating an extraordinary period for global research. Among the standout findings are revolutionary advances in immunology, ocean exploration, biotechnology, and personalized medicine that promise to transform our understanding of the natural world and the therapeutic capabilities of modern science.

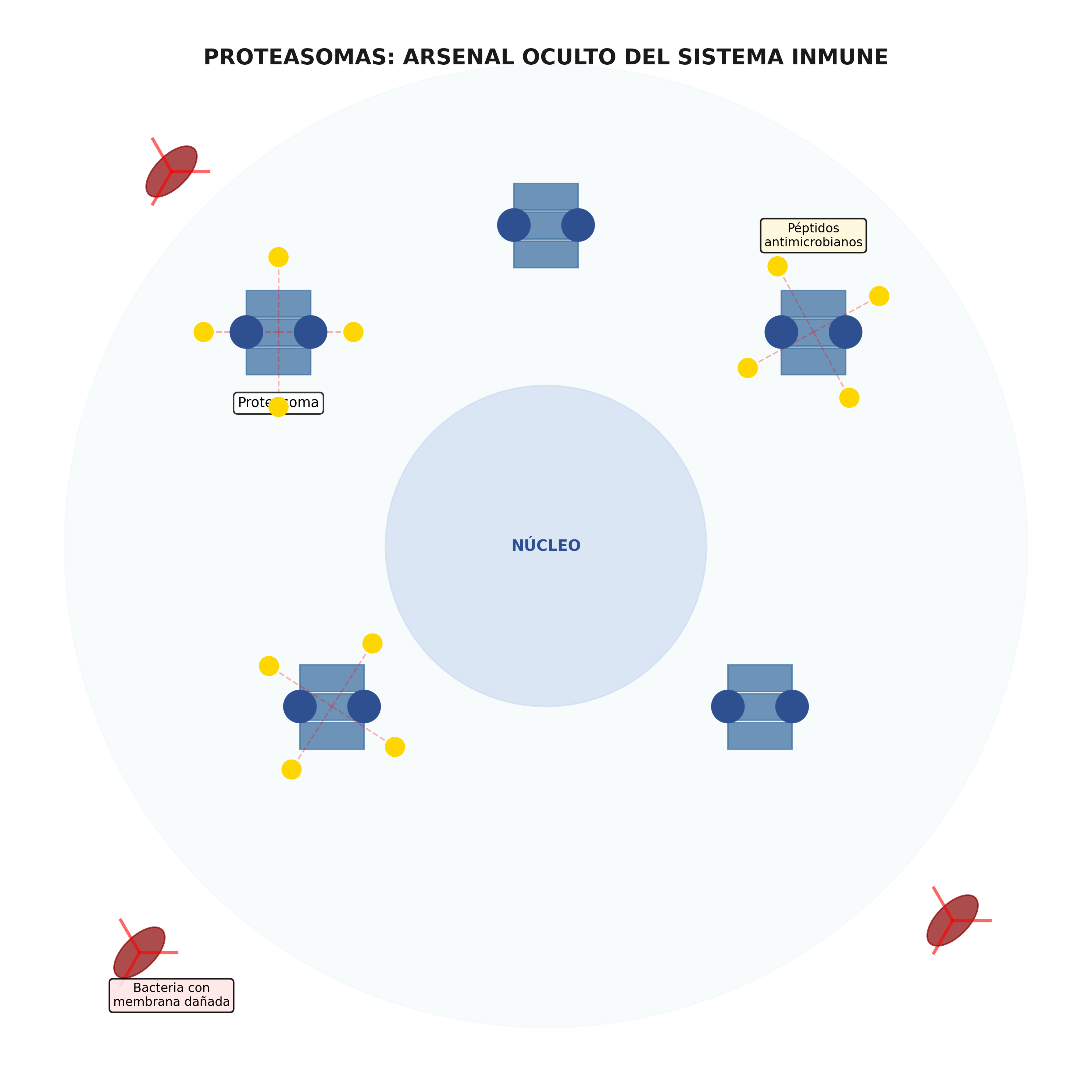

A hidden arsenal in our cells

The most shocking discovery of the year came from systems biologist Yifat Merbl and her team at the Weizmann Institute of Science in Israel. While researching proteasomes, cellular structures known primarily for their protein recycling function, Merbl identified a completely unknown ability of our immune system.

Proteasomes, which make up to two percent of a cell's protein content and degrade seventy percent of cellular proteins, turned out to have a secret mode of operation. When they detect a bacterial infection, these tiny structures change their molecular configuration and begin to produce antimicrobial peptides capable of destroying bacteria by piercing their outer membranes.

"This is really exciting because we didn't know this was happening in cells," Professor Merbl told the BBC. "We discovered a new immunity mechanism that allows us to have a defense against bacterial infections. It's happening all over our body in every cell and generates a new class of potential natural antibiotics."

The finding, published in the journal Nature in March 2025, revealed around a thousand peptide fragments with antimicrobial sequences, all of which resulted from the degradation of ordinary and unspecialized proteins. Most surprisingly, these peptides come from cellular waste machinery, which led the team to christen their research method "container diving" or "dumpster diving" in scientific terms.

Implications for the Antibiotic Crisis

This discovery comes at a critical time. Bacterial resistance to antibiotics represents one of the greatest threats to global public health. Experiments by Merbl's team showed that when proteasomes are turned off in laboratory cells, they become significantly more vulnerable to infection by bacteria such as Salmonella.

Professor Daniel Davis, director of biological sciences and immunologist at Imperial College London, called the findings extremely striking, noting that they fundamentally change our understanding of how the body fights infections. However, he cautioned that turning this discovery into a new source of clinical antibiotics still requires years of additional research.

Dr Lindsey Edwards, an expert in microbiology at King's College London, stressed that this mechanism could be especially useful in immunocompromised patients, who are more vulnerable to severe infections and have limited therapeutic options.

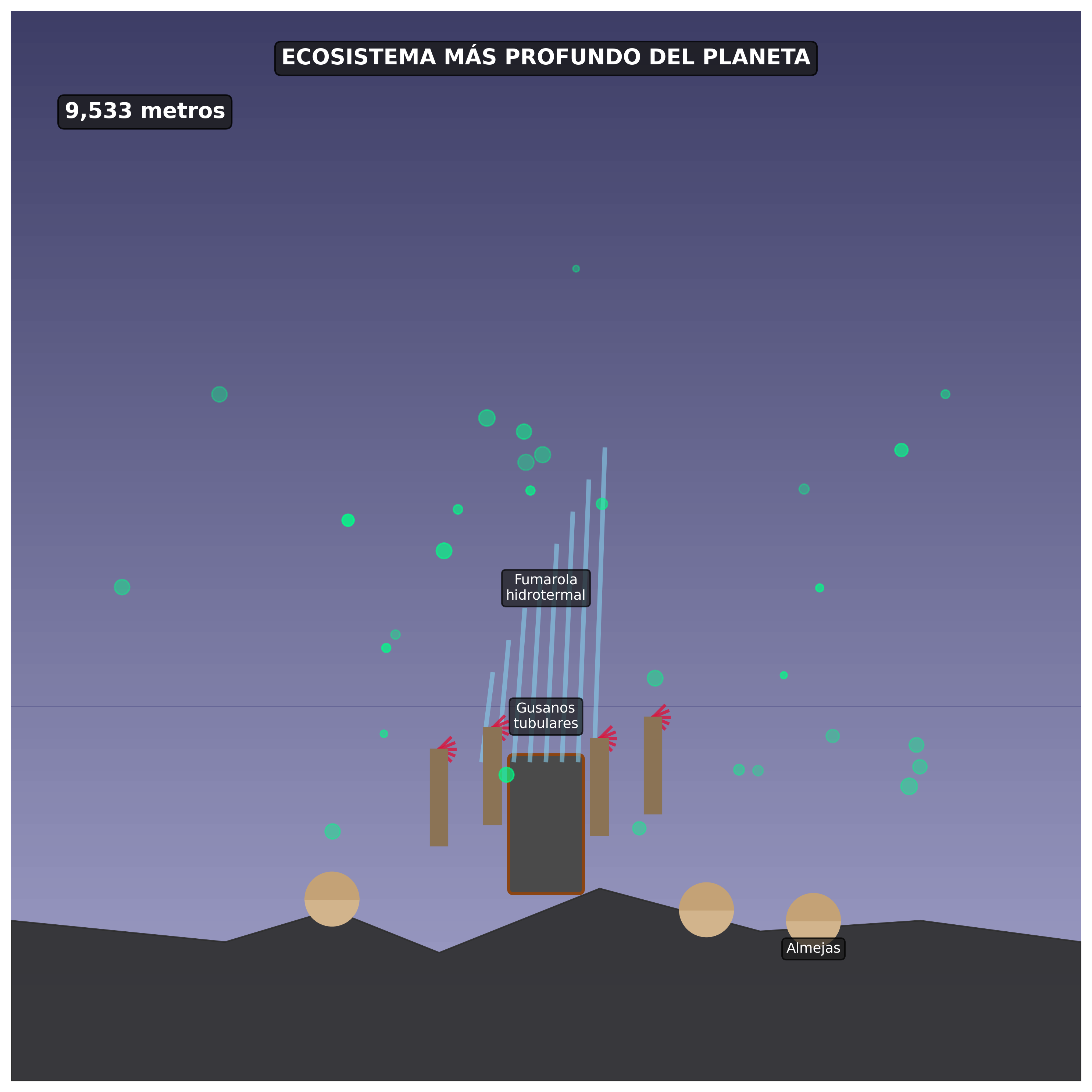

Life in the Abyss: The Deepest Ecosystem on the Planet

While Merbl explored the microscopic depths of our cells, Chinese geochemist Mengran Du descended into the most extreme depths of the Pacific Ocean. With just 30 minutes left on his underwater mission aboard the submersible Fendouzhe, Du decided to explore a final stretch of the Kuril-Kamchatka Trench between Russia and Alaska.

What he found redefined the known limits of life on Earth. At depths of up to 9,533 meters below the surface, nearly 25 percent deeper than any previous record, Du and his team at the China Institute of Deep-Sea Science and Technology documented entire communities of tube worms, clams, and mollusks thriving in conditions that seemed impossible for complex life.

Chemical oases in absolute darkness

These creatures don't rely on photosynthesis, but on chemosynthesis, a process by which symbiotic bacteria living inside them convert chemical compounds such as methane and hydrogen sulfide into usable energy. The discovery, published in Nature in July 2025, revealed a roughly 2,500-kilometer corridor of chemosynthetic ecosystems in the hadal zone of the northwest Pacific.

"Although we see the hadal trench as a very extreme environment, the most inhospitable environment, these organisms can happily live there," explained Du, who was recognized as one of the key figures in science of 2025 by Nature.

The sediment analysis revealed surprisingly high concentrations of methane, an unexpected finding that led the team to formulate a new hypothesis: microbes in these ecosystems convert organic matter in sediments into carbon dioxide and then methane, a process scientists didn't know occurred at such depths.

Implications for the global carbon cycle

This discovery has ramifications that go far beyond marine biology. The hadal trenches, as it is now understood, act not only as methane reservoirs but as active carbon recycling centers. Recent studies suggest that sediments in these areas can sequester up to 70 times more carbon than other regions of the seafloor.

Julie Huber, a deep-sea microbiologist at the Woods Hole Oceanographic Institution who was not involved in the research, expressed amazement at the extent and diversity of the communities discovered. The finding suggests that similar ecosystems could exist in other hadal trenches around the world, dramatically expanding our understanding of where and how life can thrive in extreme conditions.

Other outstanding scientific milestones

The Nature 2025 list also recognized other significant advances that are shaping the future of science and medicine.

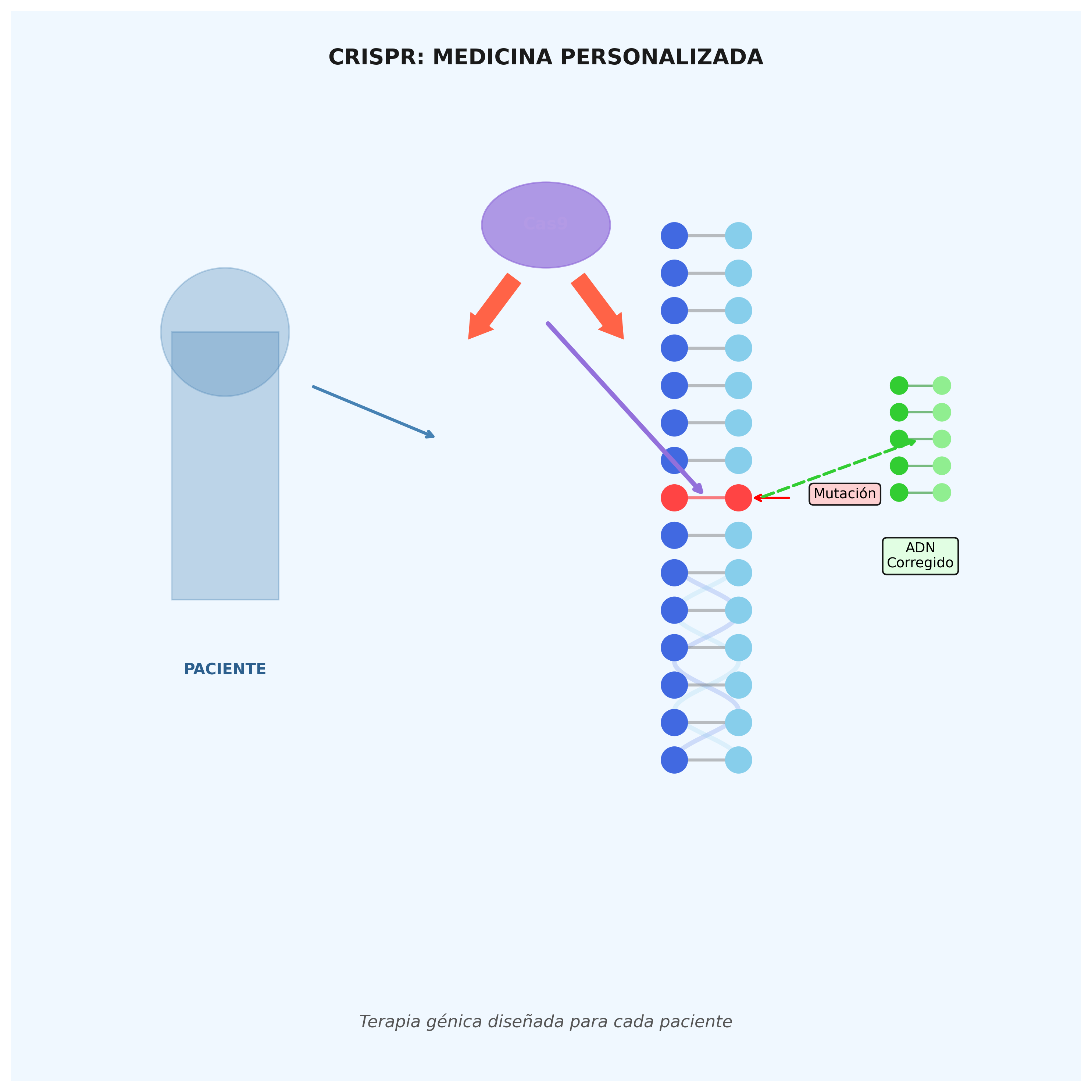

Personalized medicine with CRISPR

The case of KJ Muldoon, a child born in 2024 with CPS1 deficiency, an ultra-rare genetic disease that prevents protein processing and accumulates ammonia in a lethal way, marked an unprecedented milestone. A team of doctors and scientists from Philadelphia and Pennsylvania developed a completely customized CRISPR gene-editing therapy in just six months, designed to correct a single error in your DNA.

This treatment represents the first case of fully personalized gene therapy for an individual mutation, opening the door to a new era of precision medicine where treatments can be designed specifically for each patient's unique genetic profile.

Fighting dengue with bacteria

Brazilian Luciano Moreira developed an innovative method to combat dengue by releasing Aedes aegypti mosquitoes infected with the Wolbachia bacterium, which blocks the transmission of dengue, Zika and chikungunya viruses. This method, initially experimental, has been adopted as a national measure in Brazil, marking one of the most ambitious efforts to control vector-borne diseases.

The Vera C. Rubin Observatory

Nature also recognized the first images captured by the Vera C. Rubin Observatory in Chile, one of the largest and most advanced telescopes in the world. This instrument promises to revolutionize our understanding of the universe by mapping the entire visible sky of the Southern Hemisphere every few nights, making it possible to detect transient astronomical objects and study dark matter in unprecedented detail.

A year of scientific transformation

The discoveries of 2025 share a common thread: science's ability to reveal the unseen, whether it's digging through cellular junk to find new immune defenses or descending into the most inhospitable ocean depths to discover thriving ecosystems.

These findings not only push the frontiers of human knowledge, but also offer tangible hope in the face of some of the most pressing challenges of our time: bacterial resistance, climate change, and rare genetic diseases.

As the year draws to a close, the scientific community looks optimistically to 2026, aware that each discovery opens up new questions and possibilities. As Professor Merbl pointed out about their immunological finding, the team believes that it has only scratched the surface of this molecular universe. The same could be said of Du's hadal ecosystems and the countless mysteries that still await deep within our planet and our own cells.

###

Sources: Nature, BBC, CNN, El Universal, Weizmann Institute of Sciences, Chinese Academy of Sciences

Economic crisis and poverty in Argentina: a current x-ray of a structural problem

Poverty in Argentina is once again at the center of public debate. The most recent reports show that more than 40% of the population lives in poverty, while different organizations warn that the economic recovery has not yet managed to translate into real improvements for the most vulnerable sectors.

This panorama, far from being homogeneous, reveals a complex web of inequalities, divergent indicators and a hard core of exclusion that has persisted for more than two decades.

📉 A country where income is not enough

According to the National Council for the Coordination of Social Policies, 61% of the population had difficulty covering the total basic basket or faces problems of access to housing, health, education or social security. This alternative indicator is not limited to income: it measures rights, quality of life and access to essential services.

At the same time, the Argentine Catholic University (UCA) registered a drop in indigence and a partial recovery in income, although it warns that there is a structural core of poverty that has not changed for 20 years.

📊 Recent developments in indicators

The data show a slight improvement from the 2024 peak, but they are still alarming:

|

Indicator |

2024 (peak) |

2025 (latest data) |

2025 1º(Indec) |

|

Income poverty |

45,6% |

36,6% |

31,6% |

|

Coast (ODSA-UCA) |

49,9% |

36,3% |

-- |

|

Homelessness |

12,3% |

6,8% |

6,9% |

Despite the decline, specialists agree: economic stabilization has not yet translated into tangible improvements in daily well-being.

🧩 An uneven map: who is most affected

The reports indicate that:

- The crisis hits the lower-income sectors hardest.

- The social gap continues to widen.

- Access to basic rights continues to be a structural debt.

- The economic recovery benefits the formal sectors first, leaving informal workers and vulnerable households behind.

In addition, researchers from the Gino Germani Institute warn that 72% of workers receive salaries below what is necessary to cover the basic basket, which deepens job insecurity and economic insecurity.

🧠 Beyond the numbers: the human dimension

Poverty is not just an economic indicator. It impacts on:

- Physical and mental health

- Access to education

- Quality of housing

- Future expectations

- Job placement

- Social participation

The reports agree that multidimensional poverty – the one that measures rights and not just income – is the one that grows the most and the one that costs the most to reverse.

🔍 What do these data show about the country?

The different studies consulted reveal a clear pattern:

- Poverty in Argentina is not a circumstantial phenomenon, but a structural one.

- Recent improvements are insufficient to reverse decades of inequality.

- The economic recovery does not reach the entire population in a uniform way.

- Sustained policies that address income, rights, and quality of life in a comprehensive way are required.

📝 Conclusion: a challenge that demands more than statistics

The numbers show a slight improvement, but the daily reality of millions of Argentines continues to be marked by uncertainty, lack of opportunities and vulnerability. Poverty in Argentina is a complex phenomenon that requires multidisciplinary approaches, long-term policies and a sustained commitment from the State, the private sector and civil society.

Meanwhile, the latest reports serve as a stark reminder: the economic recovery won't be complete until it reaches everyone.

🚗 From a Hands-Free Journey to Autonomous Taxis

- by

cronywell

🚗 From a Hands-Free Journey to Autonomous Taxis

- by

cronywell

🚗 From a Hands-Free Journey to Autonomous Taxis: How a 1995 Journey Anticipated the Future of Mobility

In 1995, researchers at Carnegie Mellon traveled 4,800 kilometers without touching the steering wheel. Thirty years later, that experimental feat is reflected in the expansion of autonomous taxis in several cities in the United States.

Thirty years before driverless vehicles began to circulate on the streets of Phoenix or San Francisco, a group of researchers from Carnegie Mellon University made a demonstration that seemed to come out of a futuristic movie. In 1995, aboard a modified Pontiac Trans Sport, they traveled 4,800 kilometers from Pittsburgh to San Diego without putting their hands on the wheel, in a journey dubbed "No Hands Across America".

The experience, which combined computer vision, experimental sensors and pioneering software, marked a before and after in autonomous driving research in the United States.

🧪 An experiment that paved the way

The vehicle used, known as Navlab 5, was part of a series of prototypes developed by Carnegie Mellon's Robotics Institute since the mid-1980s. Its driving system, called RALPH (Rapidly Adapting Lateral Position Handler), analyzed in real time the images captured by a front camera to identify lanes, edges and visual references of the road.

Researchers Dean Pomerleau and Todd Jochem only intervened to accelerate or brake; the steering was automated 98% of the way, an absolute record for the time. The initiative was sponsored by Delco Electronics, AssistWare Technology and the university itself.

Although the experiment did not have an immediate impact on the automotive industry, it did become an academic milestone that inspired subsequent projects, including the DARPA Grand Challenge of the 2000s, fundamental to the development of modern autonomous driving.

🚕 Thirty years later: autonomous taxis are here

Today, three decades after that experimental journey, the fruits of that work are seen in the proliferation of autonomous taxis in cities such as Phoenix, San Francisco, Austin and Las Vegas. Companies such as Waymo, Cruise and Zoox operate fleets that transport driverless passengers, using LIDAR sensors, radars, multispectral cameras and artificial intelligence systems trained on millions of miles of data.

What in 1995 was a bold experiment, today is a commercial service that is beginning to be integrated into urban life, with specific regulations and debates on safety, privacy and coexistence with traditional traffic.

🔄 From a university prototype to a multibillion-dollar industry

The evolution from Navlab 5 to today's autonomous taxis involved advances on multiple fronts:

- Computer vision: from a single camera to multispectral systems.

- Sensors: incorporation of LIDAR, radar and ultrasound.

- Processing: from experimental computers to specialized chips.

- Mapping: from simple routes to dynamic HD maps.

- Artificial intelligence: from linear algorithms to deep neural networks.

Each of these steps was made possible by decades of research accumulated since Carnegie Mellon's first projects.

🌐 A legacy that is still in motion

The "No Hands Across America" journey not only proved that a vehicle could stay in its lane for thousands of miles; It also inaugurated a vision that today materializes in autonomous services that are beginning to be part of the urban landscape.

What seemed like a reckless experiment in 1995 is now an expanding industry that redefines mobility and poses new technological, ethical and regulatory challenges.

Dollar and Argentine economy

- by

cronywell

Dollar and Argentine economy

- by

cronywell

💵 Dollar and Argentine economy: exchange rate calm, inflationary expectations and market signals

The zero gap marks an atypical day as analysts project a 2026 with lower inflation and a higher dollar

The price of the dollar was once again at the center of the Argentine economic agenda, in a context where exchange rate stability coexists with expectations of future correction. Both the official and parallel markets showed practically identical values, an unusual phenomenon that generates different readings among economists and financial operators.

✅ Today's quotes: stability on all fronts

The official dollar was around $1430 for purchase and $1450 for sale, while the blue dollar traded at the same values. The exchange rate gap, therefore, remained at 0%, a scenario that is not usually sustained for long periods in the Argentine economy.

The tourist dollar, which incorporates an additional 30% over the official exchange rate, was positioned near $1503.40, maintaining its stable trend.

For analysts, this calm responds to a combination of factors: exchange controls, lower seasonal demand and moderate expectations of devaluation in the short term.

✅ Inflation: projections of deceleration towards 2026

The Central Bank's latest Market Expectations Survey (REM) anticipates a monthly inflation scenario of around 1.5% for May 2026, consolidating the downward trend that began to be observed in 2025.

Although the slowdown is seen as a positive sign, specialists warn that the process will depend on the recomposition of relative prices, fiscal policy and the evolution of the exchange rate.

✅ The dollar towards 2026: gradual correction, not a sharp jump

Private consultants project that the dollar could be close to $1,720 by the end of 2026, in line with a progressive adjustment of the exchange rate. The market consensus points to an orderly movement, without abrupt shocks, although conditioned by the government's ability to maintain fiscal balance and investor confidence.

✅ Financial market: caution in the face of new debt issuance

The auction of the Bonar 2029N, the first issuance of debt in dollars in eight years, generated expectation among investors. The result will be key to gauging the market's appetite for Argentine assets and the perception of the country's ability to refinance itself in foreign currency.

In the last round, bonds and stocks showed slight declines, reflecting a cautious stance pending definitions on January maturities.

✅ What does this day leave

- The zero exchange rate gap is a striking fact that could anticipate a readjustment.

- The projected downward inflation is an encouraging, if fragile, sign.

- The expected exchange rate for 2026 suggests a moderate adjustment.

- The issuance of debt in dollars will be a key thermometer for market confidence.

Winners of the Cheese World Cup

The Santa Fe cheese "Frutos del Campo" from San Carlos Sud won the silver medal at the prestigious World Cheese Awards 2025 held in Bern, Switzerland, standing out among more than 5,200 cheeses from 46 countries.

🧀 Achievement Details

- Award-winning product: a Sbrinz-type cheese, with a hard mass and intense flavor, aged for 12 months.

- Company: Frutos del Campo S.A., a dairy SME located in San Carlos Sud, Las Colonias department, Santa Fe.

- Competition: 5,244 cheeses from 46 countries participated, evaluated by an international jury of 267 experts.

- Argentine representation: only 12 companies from the country applied, and Frutos del Campo was the only one to obtain a medal.

- Organization: the contest was coordinated by the Guild of Fine Food, considered the "World Cheese Cup".

🌍 Importance of the award

- International visibility: positions the Argentine cheese industry on the world map.

- Regional pride: the commune of San Carlos Sud celebrates this achievement as a symbol of quality and tradition.

- Economic impact: it opens doors to new markets and exports for SMEs.

👉 In summary: Frutos del Campo brought the Santa Fe flavor to Switzerland and managed to make an Argentine cheese among the best in the world, consolidating the reputation of national dairy production.

The most awarded Argentine cheeses in international competitions stand out mainly in the World Cheese Awards, the most prestigious competition in the sector. In the 2025 edition held in Bern, Switzerland, Argentina won a total of 12 medals, including 2 gold, several silver and bronze.

🧀 Ranking of the most awarded Argentine cheeses (World Cheese Awards 2025)

|

Stand |

Cheese |

Producer |

Medal |

Characteristics |

|

1 |

Reggianitto 18 months |

Dairy Cowboy |

🥇 Gold |

Hard cheese, long maturation, Italian style adapted to Argentine tradition |

|

2 |

Tuscan |

Ventimiglia Cheese Factory |

🥇 Gold |

Hard dough cheese, intense flavor, made in Cordoba |

|

3 |

Sbrinz argentino |

Fruits of the Field (San Carlos Sud, Santa Fe) |

🥈 Silver |

Stationed 12 months, the only winner in Santa Fe |

|

4 |

Artisanal Blue Cheese |

Various producers |

🥈 Silver |

Recognized for its quality and distinctive flavor |

|

5 |

Pategrás Cheese |

Several Argentine SMEs |

🥉 Bronze |

Traditional on the Argentinian table, semi-hard style |

|

6 |

Argentinian Gouda cheese |

Regional producers |

🥉 Bronze |

Local adaptation of the Dutch classic |

|

7 |

Sardinian cheese |

Producers from Cordoba |

🥉 Bronze |

Strong, ideal for grating |

|

8 |

Fontina Cheese |

Patagonian producers |

🥉 Bronze |

Semi-hard, with sweet notes |

|

9 |

Argentinian Brie Cheese |

Dairy SMEs |

🥉 Bronze |

Soft cheese with moldy crust |

|

10 |

Argentinian Camembert cheese |

Boutique producers |

🥉 Bronze |

Similar to Brie, with a creamy texture |

📊 Keys to Argentina's performance

- 12 medals in total in 2025: 2 gold, several silver and bronze.

- Santa Fe, Córdoba and Patagonia were the most prominent regions.

- Hard and seasoned cheeses (Reggianitto, Tuscan, Sbrinz) are the ones that receive the most international recognition.

👉 In conclusion: the most awarded Argentine cheeses are the Reggianitto from Lácteos Vaquero and the Toscano from Ventimiglia (gold), followed by the Sbrinz from Frutos del Campo (silver). This ranking shows how the national cheese tradition manages to compete on an equal footing with powers such as Switzerland, Italy and France.

📰 Special Report | Argentine Economy

- by

cronywell

📰 Special Report | Argentine Economy

- by

cronywell

📰 Special Report | Argentine Economy

Massive closure of companies in Argentina: a phenomenon that deepens

✅ Panorama general

Argentina is going through one of the most critical periods for its productive framework in more than a decade. Between 2024 and the first quarter of 2025, 97,110 companies closed and only 79,787 opened, which left a negative balance of 17,323 firms and a net loss of 17,949 registered jobs, according to official data from the Ministry of Labor.

The deterioration was not abrupt, but persistent: each quarter showed a decline in the number of active companies, with a trend that has not yet found a bottom.

📉 Quarterly evolution of company closures

Official data show a sustained drop:

|

Quarter |

Net balance of enterprises |

Situation |

|

1° 2024 |

–5.553 |

Onset of deterioration |

|

2° 2024 |

–4.627 |

Falling consumption and cost pressure |

|

3° 2024 |

–2.804 |

Slowdown, but still in the red |

|

4° 2024 |

–2.042 |

Mild moderation |

|

1° 2025 |

–2.297 |

Persistence of the closure of signatures |

In total: more than 17,000 fewer companies in 15 months.

🏭 Sectoral impact: industry on alert

The industrial sector is one of the hardest hit. In the last weeks of November 2025 alone, five manufacturing companies closed their plants, leaving more than 400 workers laid off in Buenos Aires, La Rioja and San Luis.

The most affected items:

- Metallurgy

- Appliances

- Textile

- Auto Parts

The combination of falling domestic consumption and increased imports deepened the crisis in medium and large factories.

🧊 Emblematic case: Whirlpool abandons local production

The American multinational Whirlpool announced the definitive closure of its washing machine plant in Pilar, leaving 220 employees unemployed and putting an end to its industrial activity in the country.

The company will continue to operate only as an importer and distributor, a structural change that reflects the loss of competitiveness of the Argentine manufacturing sector.

📌 Factors that explain the phenomenon

🔹 1. Fall in domestic consumption

The contraction of purchasing power reduced demand in almost all areas.

🔹 2. Opening of imports

The flexibility of foreign trade generated strong competition for local industry, especially in durable goods and textiles.

🔹 3. Rising operating costs

Rates, logistics, rents and tax burdens put pressure on profitability.

🔹 4. Macroeconomic instability

Exchange rate volatility and lack of predictability discourage investment and make planning difficult.

👥 Impact on employment

The net loss of nearly 18,000 registered jobs does not reflect the full impact, as many businesses that continue to operate also cut staff or adjusted production shifts.

🔮 Perspectives

Although some indicators show a moderation in job destruction towards the end of 2024, the trend of business closures continues in 2025. Recovery will depend on:

- Macroeconomic stability

- Production incentives

- Smart import protection policies

- Reactivation of domestic consumption

With no clear signs of reversal, Argentina's productive framework faces a historic challenge.

Nature reveals the most important scientific discoveries of 2025

Nature reveals the most important scientific discoveries of 2025